February Week 3 Market Update

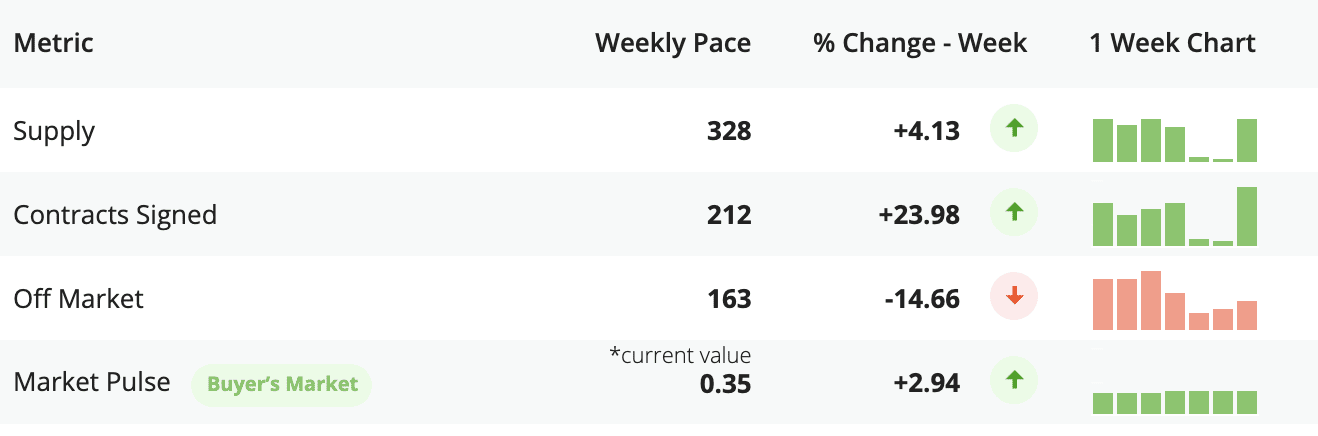

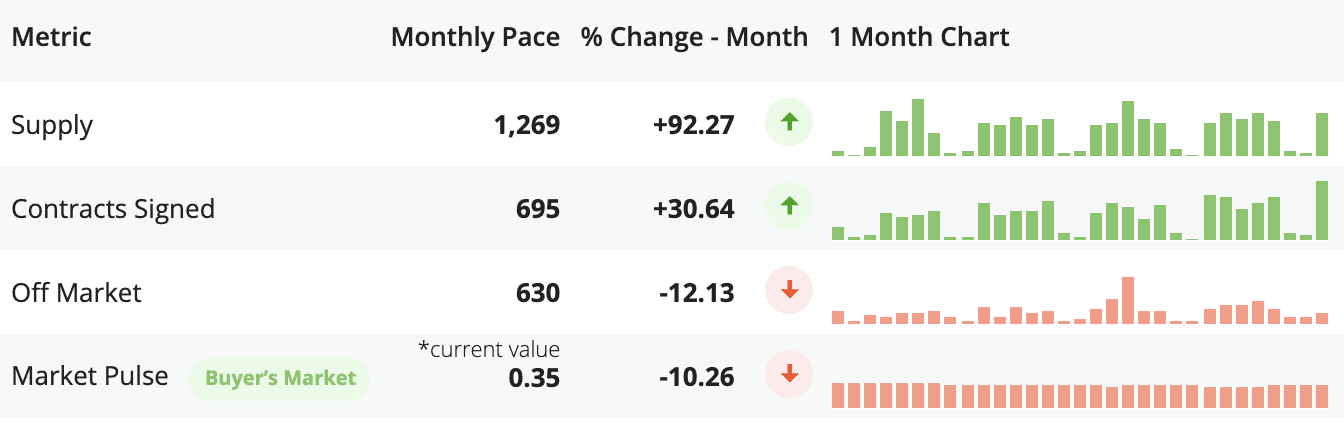

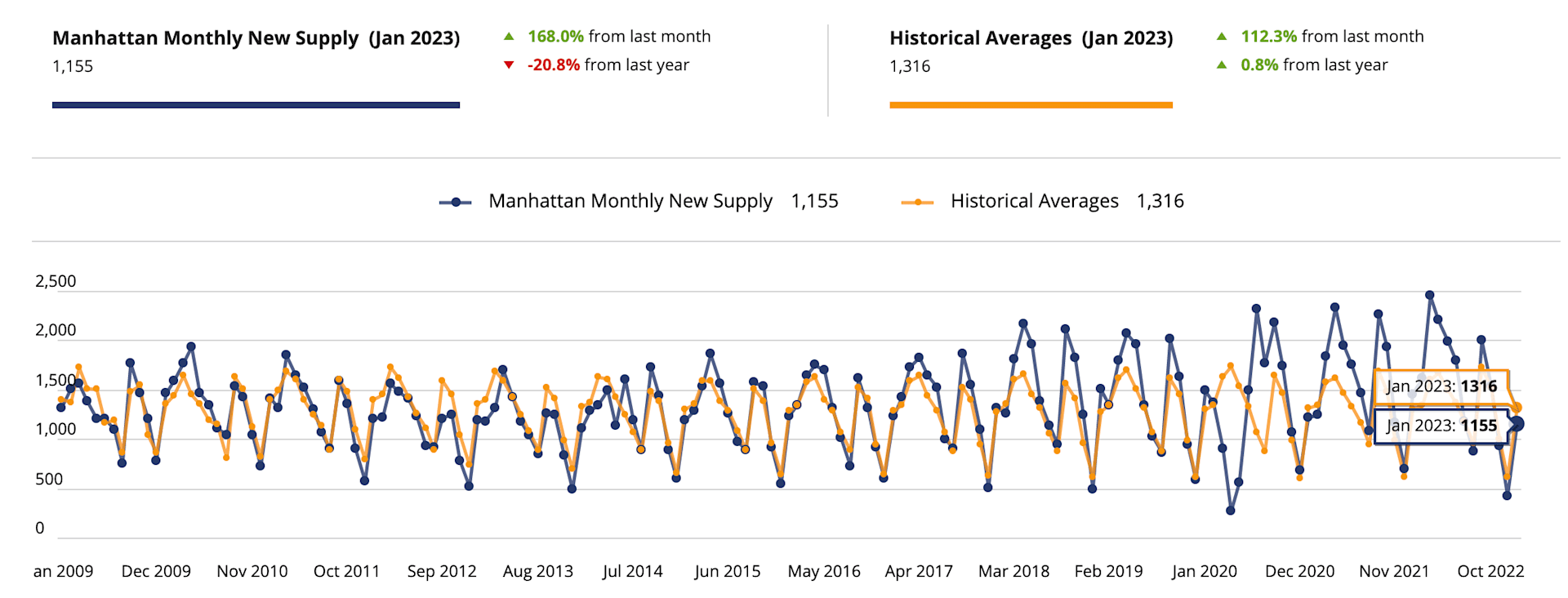

This past week 328 properties got listed for sale. This is roughly the same as the week prior. The challenge is that there are a lot less properties on the market now than is typical for this time of year. Buyers are out there looking for properties, and don’t have as many options as they would like (1155 units got listed in January 2023 vs 1316 units, which historically is what gets listed for sale).

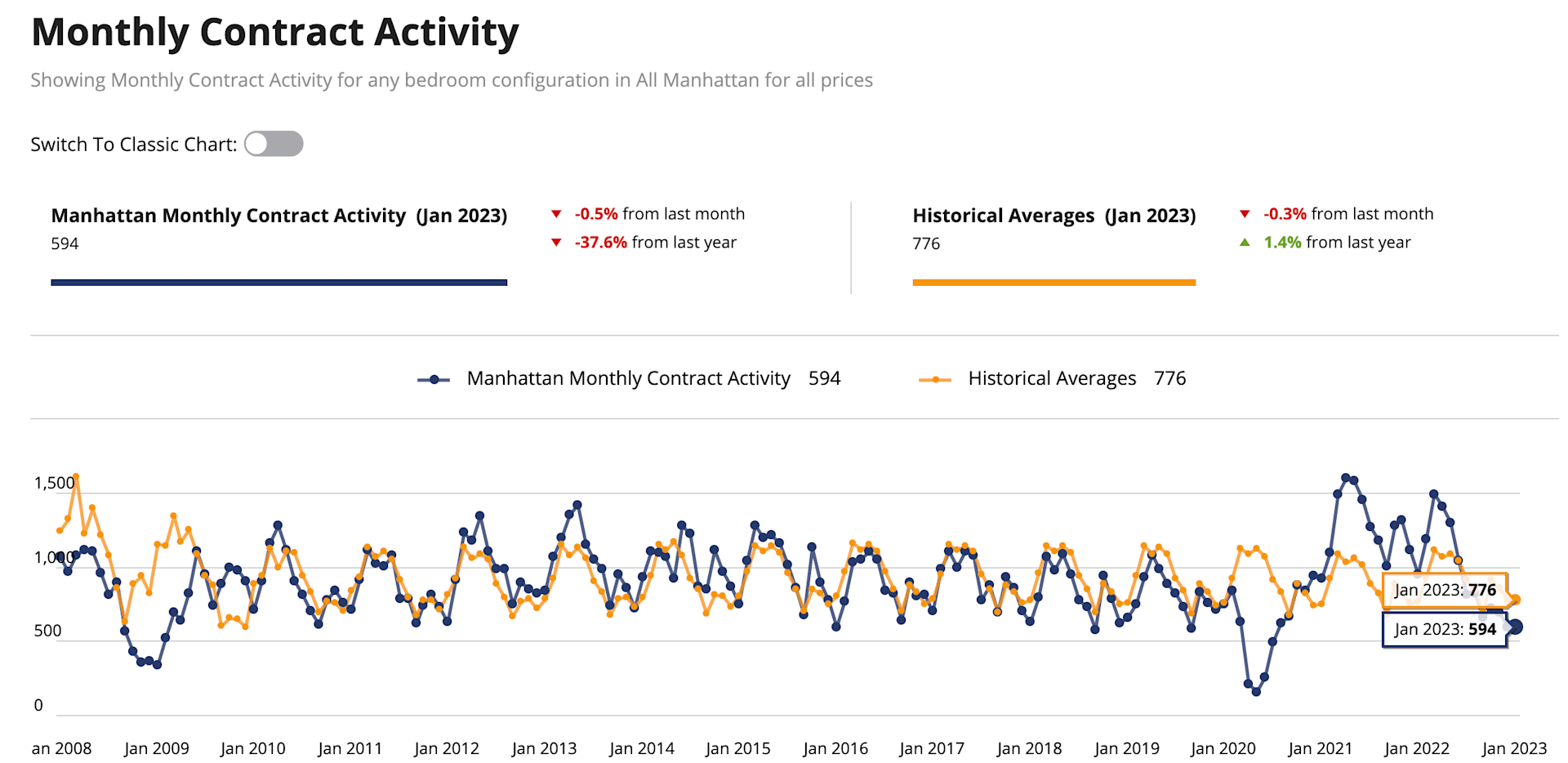

This past week, 212 properties went into contract, a nice increase of almost 24% from the week prior but we are still in a low-volume environment with approximately 42% less properties in contract at the moment (594 units went into contract in January 2023 VS 776 which is what historically goes into contract in January).

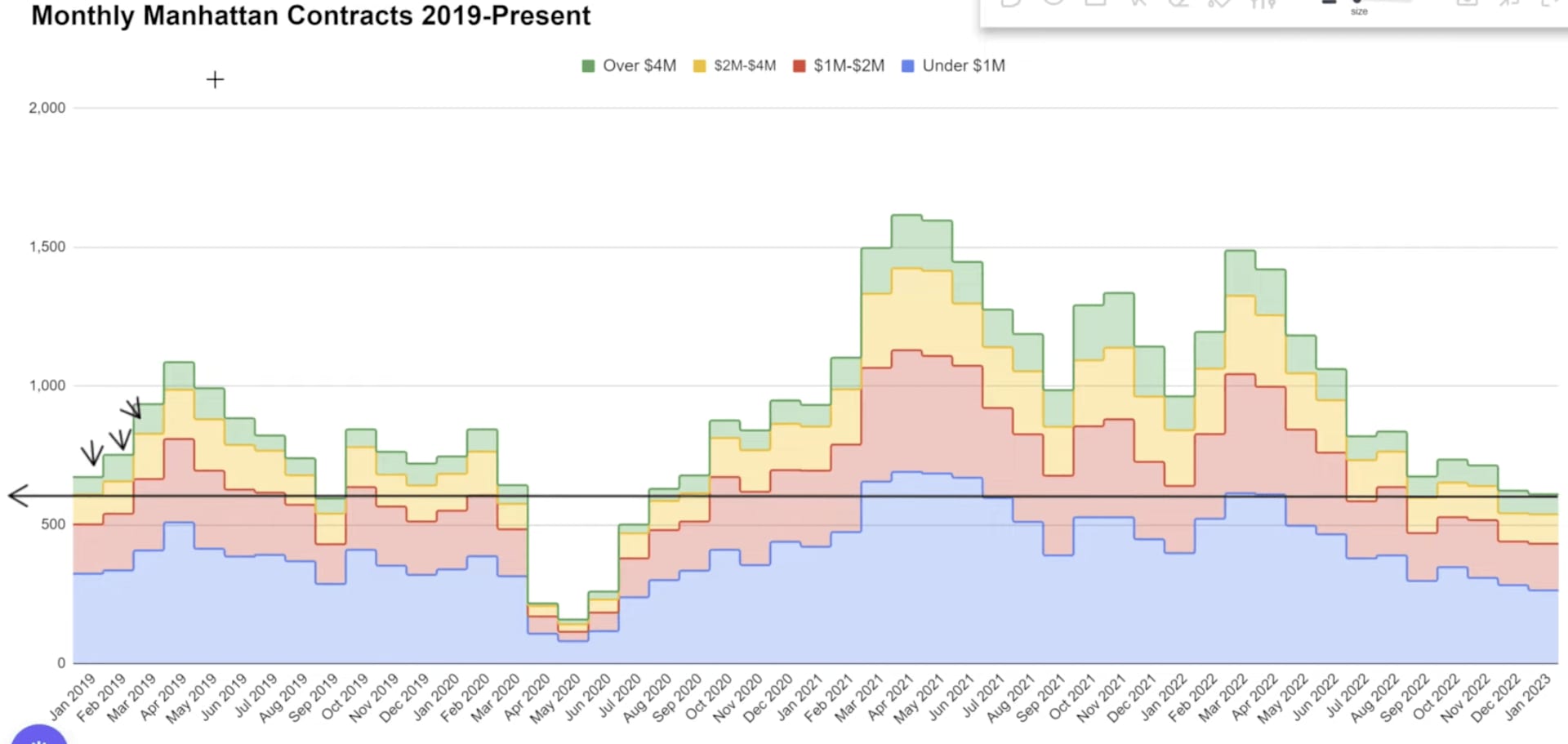

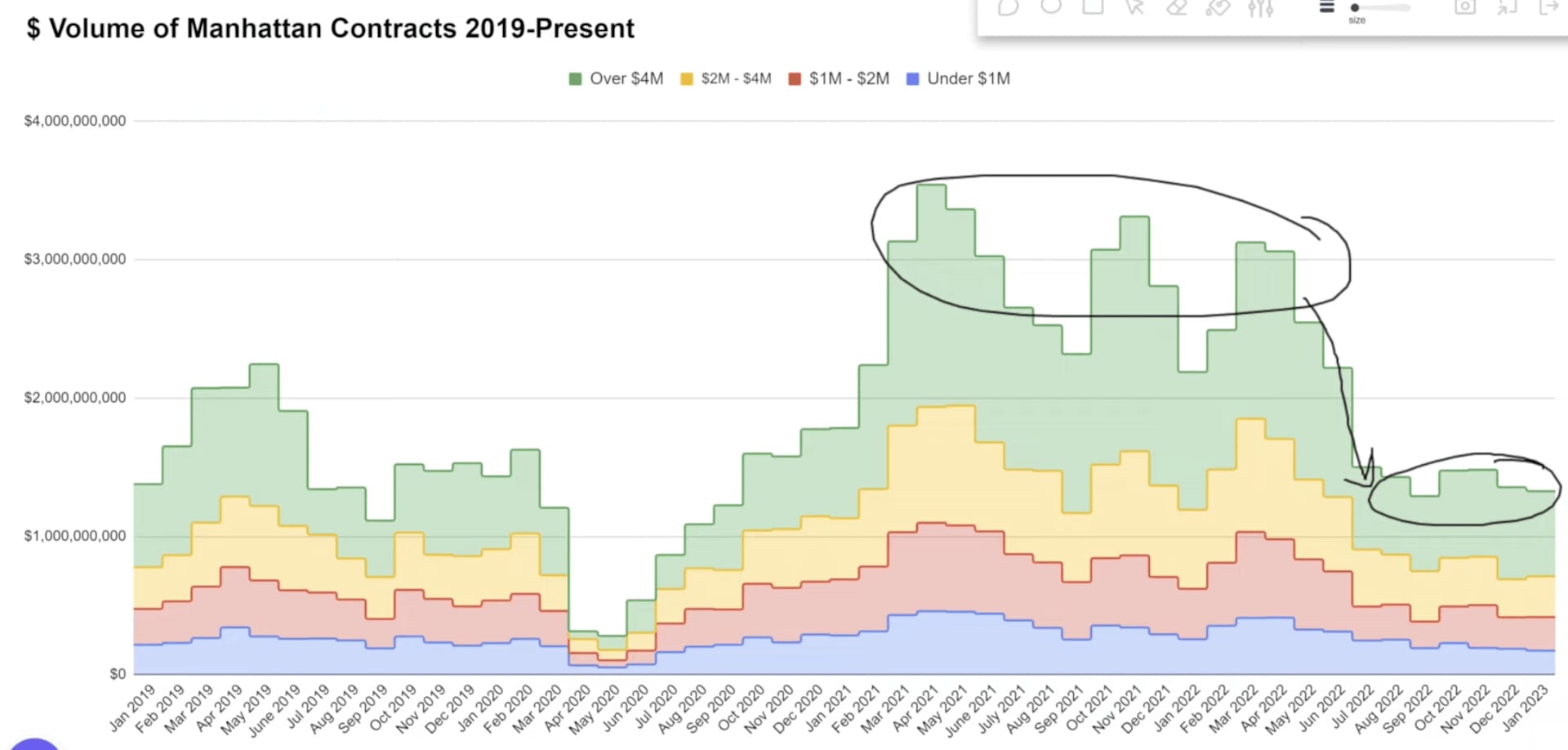

If you want a quick visual on this, look at the $ Volume of Manhattan Contracts 2019 to present. It's not only interesting to see how the over $4M sales really accelerated in 2021, but it also shows you how we are back to 2019 volume of sales, which was a slow period of time.

If you want to see a forecast of where we should be going, if we follow 2019 patterns, look at the Monthly Manhattan contracts 2019 - present and see how in January, February, and March the number of properties in contracts increased. If you look at most years you will see the number of properties in contract increase from January until May and then start to decrease as less properties get sold in the second half of the year.

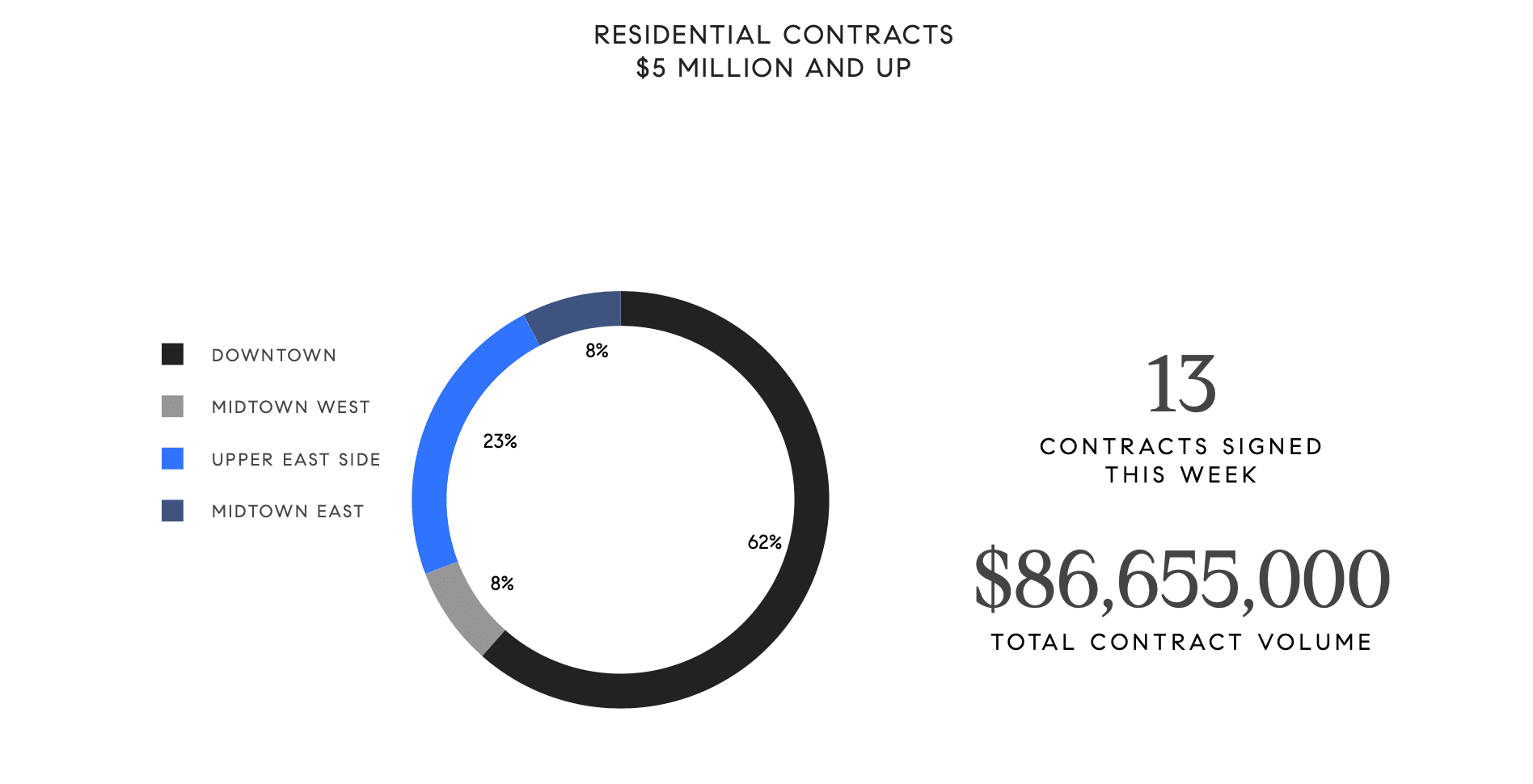

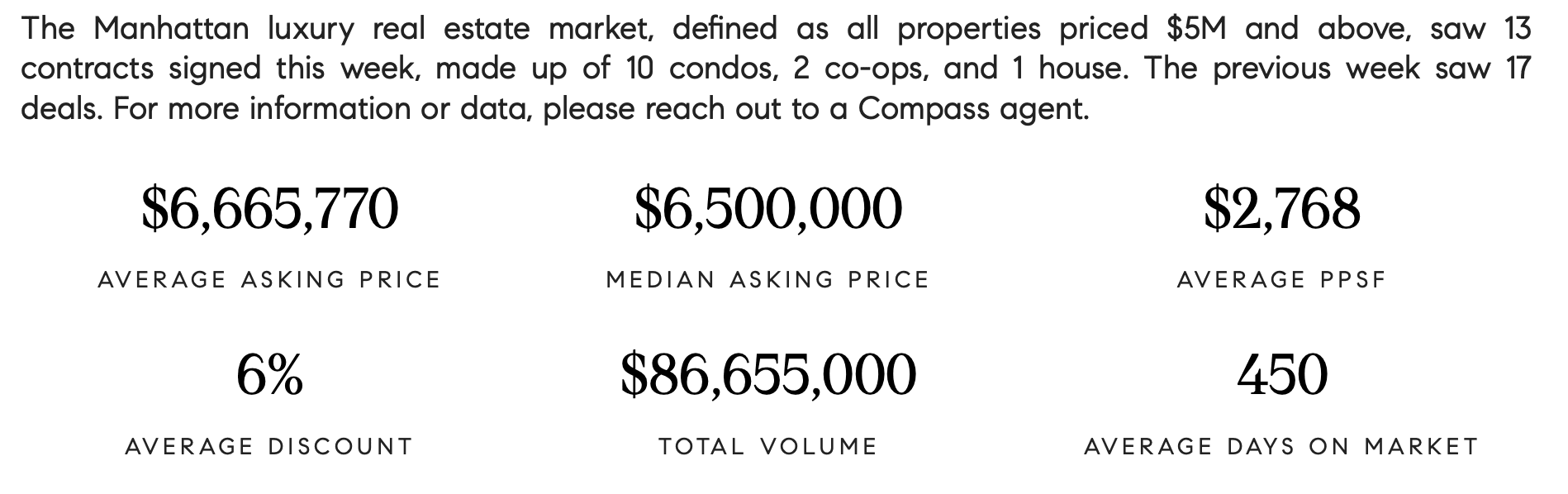

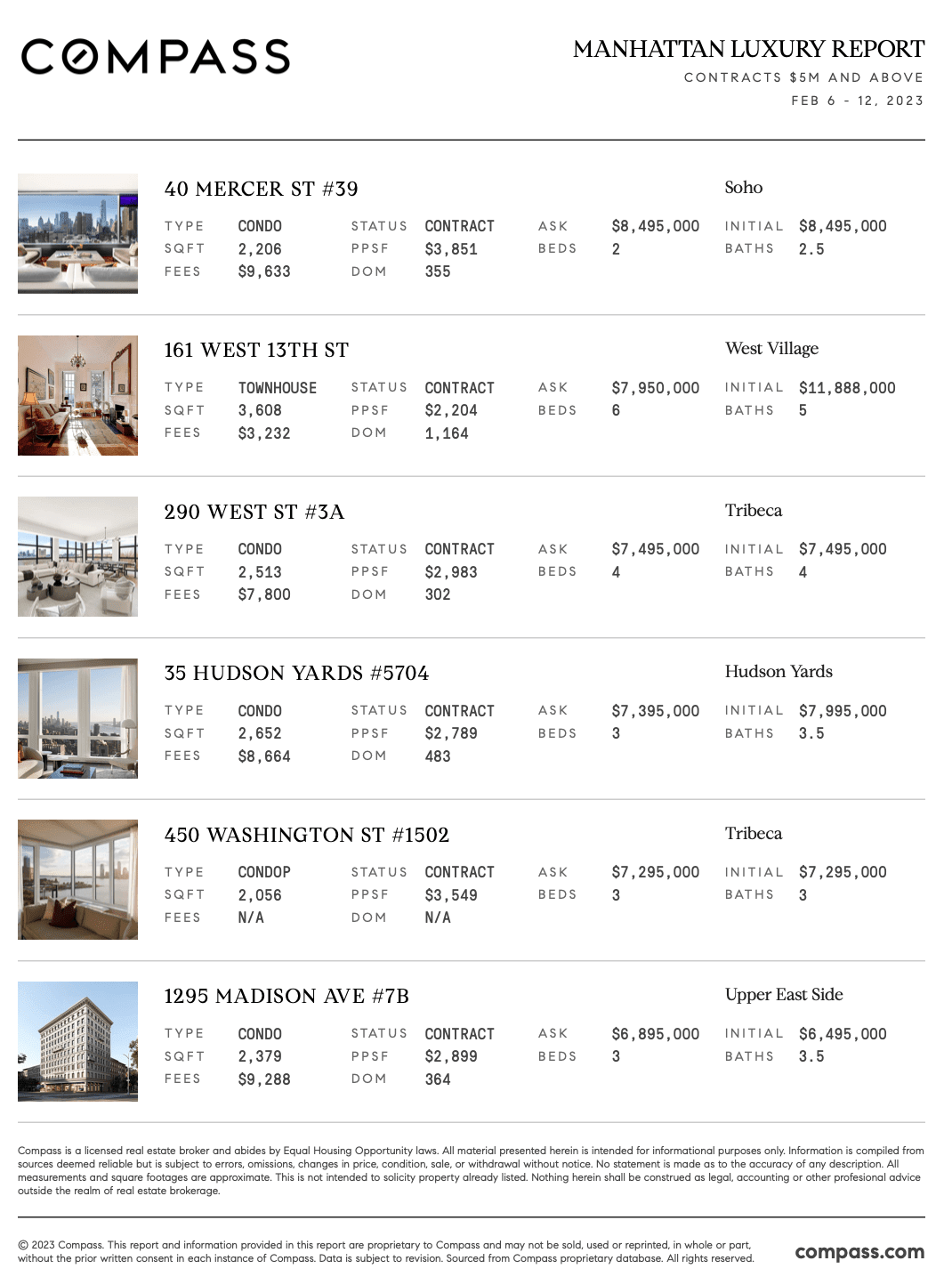

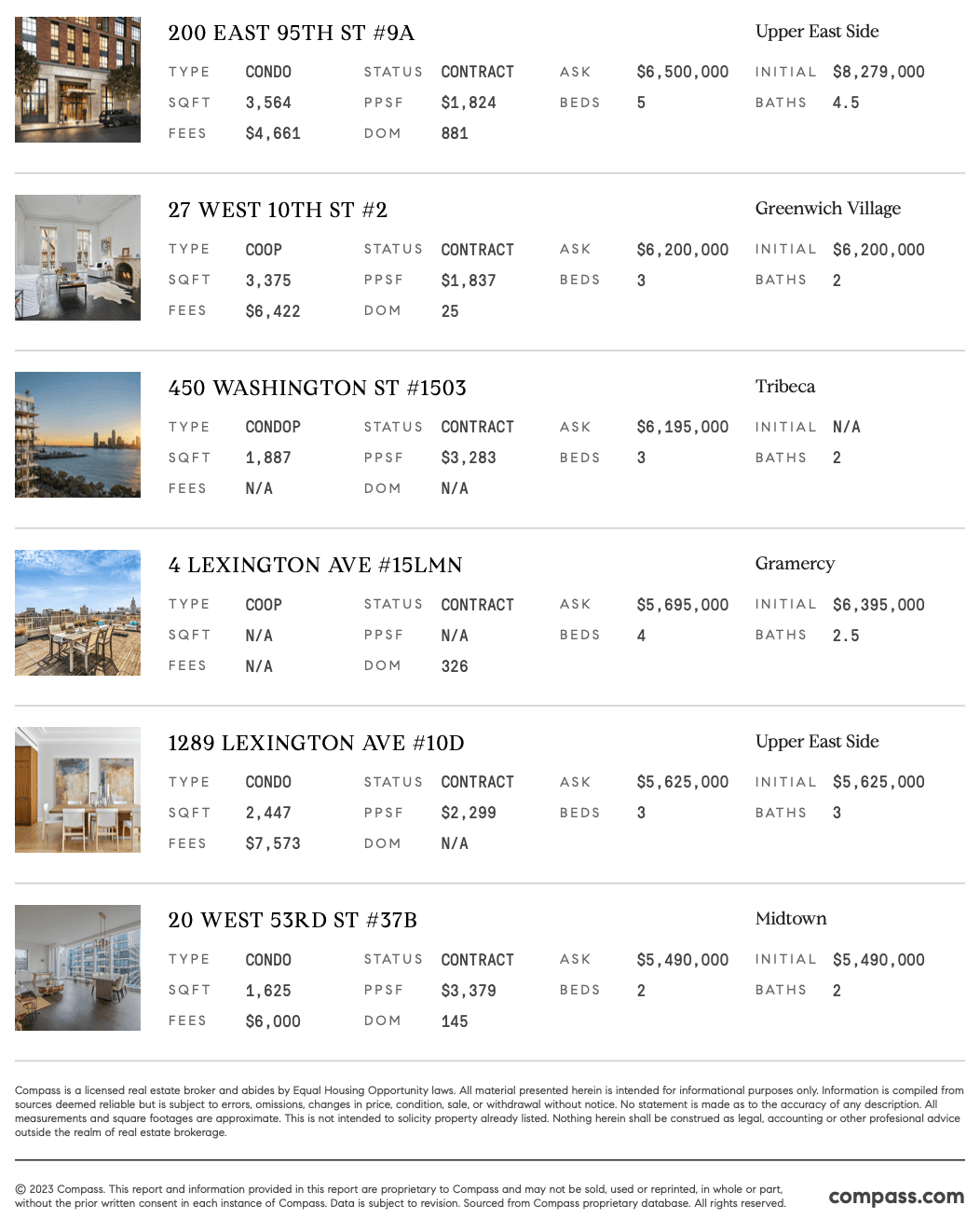

The Luxury Sector $4 / $5M + sales:

The Manhattan luxury real estate market, defined as all properties priced $5M and above, saw 13 contracts signed this week, made up of 10 condos, 2 co-ops, and 1 house. The previous week saw 17 deals. If we define luxury at $4M then 25 contracts were signed and it's the second week that we had over 20 luxury sales. But interestingly enough, only two were over $10M! See below for details on these past sales!

Open Houses:

There were 4,784 open houses in New York City this past weekend. Internally, we have projected that between 3-5 people have come to the open houses. That is an uptick from the week before and does fit the cycle we are in where more and more buyers are out shopping as we continue into our listing season.

New Development:

“Contract volume is having its best run since June 2022 when rising mortgage rates forced a significant % of buyers to the sideline or into leases. After spending 16 consecutive weeks below the historical* average, demand for new dev appears to have broken through its resistance level and forecasts an active Spring."

“Contract volume recorded its highest weekly tally since September 2022 and remained above its pre-pandemic benchmark for the third consecutive week. That historical average is 53 contracts, while 62, 58, and 63 contracts were signed over the past 3 weeks. Because the average deal, $2.21M, was 11% less expensive than last week, the other metrics were down as well. Total dollar volume dipped from $144M to $139M and average PPSF was down from $1,781 to $1,690.” - Market Proof

How’s the market? Should I list my property?

The most popular question I get every single day is: HOW'S THE MARKET? Honestly, it's a complicated answer. For the last six months, the market in New York City has been in limbo. It's as if we were skiing the triple black diamond and now we are on the bunny slope deciding if we should take the lift back up.

We have 41% less properties in contract than we did this time last year. 5,300 properties were taken off the market in the last 6 months as sellers decided to remove their listings, and sometimes transition to rentals. This “off market” phenomenon left buyers who were feeling like they had all the leverage of an upper hand, looking at few options to choose from. As a result, 13% of properties still are selling above the asking price.

That brings me to the next most popular question I get: SHOULD I LIST MY PROPERTY?

The answer is: it depends. There are economic and macro forces we pay attention to, as well as hyper local data such as comparable properties for sale and sold. When you are prepared to meet the buyer demand without competition, you will have the greatest chance for the best price and terms. Buyers are not seeing a great deal of new listing options. I’m finding that sellers who list their homes now are getting a great turn out at the showings. While it is “officially” a buyers market, the slow volume is keeping the market strong for sellers as well.

My almost two decades of experience have led me to a point where I have a feeling for where the market is going, and then statistics follow suit. If you want to know the value of your apartment, I’ll be happy to share my highly accurate broker insights, and also share with you the data and reports substantiating my pricing opinion. I track these statistics on a daily basis, and share them on a weekly basis as well. Let me know if you want to subscribe to my weekly email update or want a free valuation of any properties!